Carbon Black Market Hits USD 23.17 billion by 2035 on Specialty & Sustainable Drive

Growth fueled by EV batteries, recovered carbon, and specialty applications; US leads at 76% North America share, China fastest-growing at 5.2% CAGR

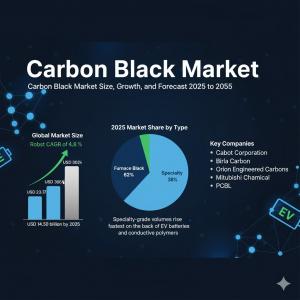

NEWARK, DE, UNITED STATES, November 6, 2025 /EINPresswire.com/ -- The global carbon black market is projected to expand from USD 14.50 billion in 2025 to USD 23.17 billion by 2035, at a CAGR of 4.8%. Growth is being driven by the rise of electric vehicles, the scaling of specialty-grade applications in inks, coatings, and plastics, and the increasing adoption of recovered carbon black (rCB) for sustainable tire production. The United States remains the largest national market, while China is set to lead growth globally. Tightening emissions regulations and OEM demand for low-rolling-resistance tires are reshaping production priorities across the industry.

The market is pivoting toward high-performance, low-footprint carbon black, where ultra-pure acetylene black for batteries and rCB for circular economy initiatives are gaining traction. Specialty grades now command higher margins, and sustainability-linked innovations are moving from pilot to commercial scale. For manufacturers and material suppliers, the shift represents both a premium opportunity and a compliance imperative.

Review the full report to examine in-depth market dynamics, strategic developments, and growth opportunities across key regions! Request Sample Report: https://www.futuremarketinsights.com/reports/sample/rep-gb-17215

Fast Facts

* Market Size (2025): USD 14.50 billion

* Market Size (2035): USD 23.17 billion

* CAGR (2025–2035): 4.8%

* Top Product Segment: Specialty-grade carbon black (CAGR 5.8%)

* Form Leader: Furnace black (Data not disclosed in client file)

* Source Leader: Recovered carbon black (rCB) moving toward mainstream OE approval

* Growth Hubs: China (CAGR 5.2%), India (CAGR 5.0%), South Korea (CAGR 4.8%)

What is Winning and Why

Shoppers—primarily OEMs—are favoring carbon blacks that combine performance with sustainability.

- Product Leader: Specialty-grade black, enabling battery, coating, and polymer applications

- Form Leader: Acetylene black, critical for high conductivity (<5 Ω·cm) and low metal ash (<20 ppm)

- Source Leader: Recovered carbon black, clearing PAH thresholds and scaling to commercial tonnage

Where to Play

Manufacturers should focus on both traditional and emerging channels: industrial rubber, battery materials, and high-value coatings/plastics.

- United States: Largest North American market, early rCB adoption, 4.5% CAGR

- China: EV and tire growth, fastest global CAGR at 5.2%

- India: Tire, automotive, and construction demand, CAGR 5.0%

- Germany: Automotive and specialty applications, CAGR 4.6%

- South Korea: EV batteries and specialty black, CAGR 4.8%

What Teams Should Do Next

R&D

- Advance specialty and acetylene black formulations for EVs

- Scale recovered carbon black purification technologies

- Explore nanostructured carbon black for energy storage

Marketing & Sales

- Highlight sustainability and low-carbon credentials in B2B campaigns

- Target specialty applications in coatings, polymers, and electronics

- Build partnerships with EV battery and tire OEMs

Regulatory & QA

- Ensure ISO 14001, REACH, and national compliance

- Implement ESG traceability and scope-3 carbon accounting

- Audit supply chain for recovered carbon quality

Sourcing

- Diversify feedstock to hedge oil volatility

- Secure rCB supply through joint ventures or MOUs

- Invest in bio-based or circular feed alternatives

Acquire the complete report to access detailed projections, country-level insights, company share assessments, and technology outlooks! Buy Full Report: https://www.futuremarketinsights.com/checkout/17215

Three Quick Plays This Quarter

- Launch pilot rCB-based tire compound in collaboration with OEM

- Optimize specialty-grade black dispersion for electronics coatings

- Negotiate multi-year acetylene black supply contracts

The Take

The carbon black market is at a pivot point: performance, sustainability, and EV-driven demand are converging. Leaders who integrate recovered and specialty carbon blacks into industrial, tire, and battery applications will capture outsized growth. Weekly production decisions now link directly to margin mix, regulatory compliance, and long-term OEM partnerships.

Media Line

For analyst briefings or custom cuts by product, form, source, and country, contact Future Market Insights.

Exploring Insights Across Emerging Global Markets:

Rubber Molding Market: https://www.futuremarketinsights.com/reports/rubber-molding-market

Performance Elastomer Market: https://www.futuremarketinsights.com/reports/performance-elastomer-market

High Performance Fluoropolymer Market: https://www.futuremarketinsights.com/reports/high-performance-fluoropolymer-market

UV Curable Resin and Formulated Products Market: https://www.futuremarketinsights.com/reports/uv-curable-resin-and-formulated-products-market

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

Why Choose FMI: Empowering Decisions that Drive Real-World Outcomes: https://www.futuremarketinsights.com/why-fmi

Sudip Saha

Future Market Insights Inc.

+18455795705 ext.

email us here

Visit us on social media:

Other

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.