EU Oat Drink Market to Hit USD 434.7 Million by 2035 — Growth Driven by Coffee, Health & Sustainability, FMI Report

The EU oat drink market is set for strong growth, driven by rising plant-based consumption, health-conscious trends, and sustainable beverage demand.

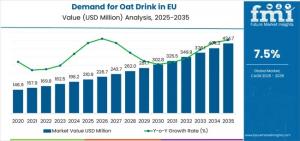

NEWARK, DE, UNITED STATES, November 11, 2025 /EINPresswire.com/ -- The European Union oat drink industry is on a remarkable growth trajectory, projected to expand from USD 210.9 million in 2025 to USD 434.7 million by 2035, reflecting a robust CAGR of 7.5%. The surge in demand is largely driven by increasing consumer adoption of plant-based beverages, expanding café culture with barista-grade oat drinks, and the rising application of oat drinks in breakfast, cooking, and ready-to-drink (RTD) formats.

According to recent insights from FMI, the EU oat drink market is expected to more than double in size over the next decade, as sustainability-conscious consumers and health-focused trends redefine dairy alternative consumption.

See How This Report Can Support Your Strategic Planning. Request Sample Report With Complete Market Breakdowns And Growth Estimates. https://www.futuremarketinsights.com/reports/sample/rep-gb-27174

Key Market Highlights

• Leading Product Type: Regular/Full Fat oat drinks hold a dominant 75.0% share in 2025.

• Top Application: Coffee-based drinks (barista) account for 45.0% of consumption.

• Growth Drivers: Rising barista-grade adoption, plant-based nutrition awareness, and innovative product portfolios.

• Key Countries: Germany, France, Spain, Italy, Netherlands, with Rest of Europe showing emerging adoption.

Demand Dynamics (2025-2035)

• 2025-2030: The market is expected to grow from USD 210.9 million to USD 302.8 million, contributing 41.1% of total growth. Growth is fueled by barista-grade formulations, product taste enhancements, and functional parity with dairy milk.

• 2030-2035: Sales will rise from USD 302.8 million to USD 434.7 million, adding USD 131.9 million, driven by premium varieties, organic formulations, functional ingredient integration, and sustainable production practices.

Between 2020 and 2025, the EU oat drink market grew at 7.5% CAGR, reaching USD 210.9 million. This period marked mainstream adoption, strengthened by health-conscious consumers, superior frothing performance for coffee, and product innovation enhancing taste and texture.

Why EU Consumers Are Embracing Oat Drinks

• Rapid growth of flexitarian and vegan consumers seeking dairy alternatives.

• Oat drinks as a functional dairy replacement in coffee, smoothies, breakfast cereals, and cooking.

• Sustainability awareness: Oat drinks have a lower carbon footprint compared to dairy milk.

• Preference for certified and fortified products, ensuring transparency, quality, and nutritional benefits.

Segment Analysis

By Product Type: Regular/Full Fat remains dominant, though slightly declining from 75.0% in 2025 to 73.0% by 2035. Advantages include:

• Authentic milk-like taste.

• Versatile use across coffee, breakfast, smoothies, and cooking.

• Superior frothing performance for barista applications.

By Application: Coffee-based/barista drinks represent 45.0% of EU demand in 2025, growing to 46.0% by 2035. Drivers include:

• Frothing and microfoam performance.

• Taste neutrality compatible with espresso.

• Expansion of café channels boosting visibility.

Drivers, Trends, and Challenges

• Barista-Grade Innovation: Advanced enzyme treatment, homogenization, and protein stabilization enable microfoam creation and latte art.

• Functional Ingredients: Calcium fortification, vitamin D enrichment, and protein supplementation enhance nutritional parity with dairy.

• Sustainability Focus: Regenerative agriculture partnerships, circular packaging, and carbon footprint measurement appeal to eco-conscious consumers.

Challenges include oat supply volatility, refrigerated logistics constraints, and evolving regulatory labeling requirements.

Regional Insights

• Germany: Leading market with 16.8% share in 2025, CAGR of 8.3%, strong café culture, environmental consciousness, and established retail infrastructure.

• France: CAGR 7.6%, driven by urban café culture, specialty coffee demand, and premium positioning.

• Italy: CAGR 7.4%, growth fueled by urban health-conscious consumers and emerging café culture.

• Spain: CAGR 7.5%, supported by retail expansion, sustainability awareness, and private-label adoption.

• Netherlands: CAGR 7.5%, innovation leadership, sustainability focus, and advanced retail presence.

To Access The Full Market Analysis, Strategic Recommendations, And Analyst Support, Purchase The Complete Report Here. https://www.futuremarketinsights.com/checkout/27174

Competitive Landscape

The EU oat drink market is characterized by competition among multinational beverage companies, specialized plant-based brands, and emerging oat drink producers. Leading players include:

• Danone (Alpro): ~18% share, leveraging retail and café partnerships.

• Oatly AB: ~16% share, barista-grade innovation leader.

• Valsoia S.p.A.: ~6% share, Italian market expertise.

• Abafoods s.r.l.: ~4% share, organic/private-label focus.

• Earth’s Own: ~2% share, niche EU presence.

Collectively, other players account for 54% of market share, highlighting a fragmented yet opportunity-rich competitive landscape.

Why FMI: https://www.futuremarketinsights.com/why-fmi

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.